Swiss Companies in China Experience a Post-COVID Confidence Boost

The newly published “Swiss Business in China Survey,” reveals that Swiss companies in China have exhibited resilience during the pandemic, utilizing the crisis to enhance operational efficiency and benefit from reduced competition. We analyze the key findings and takeaways, and their value for foreign companies in China.

Swiss companies operating in China have experienced a significant boost in confidence and are expecting higher profits in the post-COVID era. According to the recent Swiss Business in China Survey (hereinafter referred to as the “Survey”), conducted by the University of St. Gallen (HSG), the Swiss Centers Group, and other prominent organizations in partnership with the Embassy of Switzerland in China, the Swiss business community in China has regained its optimism. A staggering 62 percent of respondents anticipate higher or substantially higher profits in 2023 compared to the previous year.

The Survey, which included feedback from 111 Swiss companies representing both small and large enterprises, provides valuable insights into the state of Swiss businesses in China. Notably, the resurgence of confidence among these marks a significant milestone, with the confidence index reaching its highest level since 2014, indicating a renewed positive outlook for Swiss companies in China.

While this data showcases the optimism prevailing among Swiss companies, it is crucial to note that there are considerations and challenges that decision-makers need to address. The Survey highlights the importance of reassessing the situation and reconnecting with teams in China. However, despite the enthusiasm observed, it is worth noting that Swiss business leaders are adopting a cautious approach to expanding their businesses and are still evaluating new investments. The focus is on refining China’s strategies to navigate emerging challenges, such as supply chain diversification and geopolitical tensions.

In this context, 2023 promises to be a year of both recovery and a critical period for reevaluating how to conduct business with China. C-level executives can benefit from comparing their own assessments with the views expressed by their peers, as it allows for a comprehensive understanding of the evolving landscape and informed decision-making.

In this article, we will delve into the key findings of the Survey, highlighting the post-COVID confidence boost among Swiss companies in China. We will explore the impact of the zero-COVID measures on sales and business operations, analyze the investment plans and decision-making process of Swiss firms, and discuss the top challenges faced by these companies. Overall, these findings offer valuable insights into the current state and future prospects of Swiss – and, more broadly speaking, European – companies in China’s evolving business landscape.

Key findings

The 2023 Survey provides valuable insights into the current business environment for Swiss companies operating in China. It allows for direct comparisons between the post-zero-COVID era and pre-pandemic years, shedding light on Swiss firms’ evolving dynamics and challenges.

General business sentiment

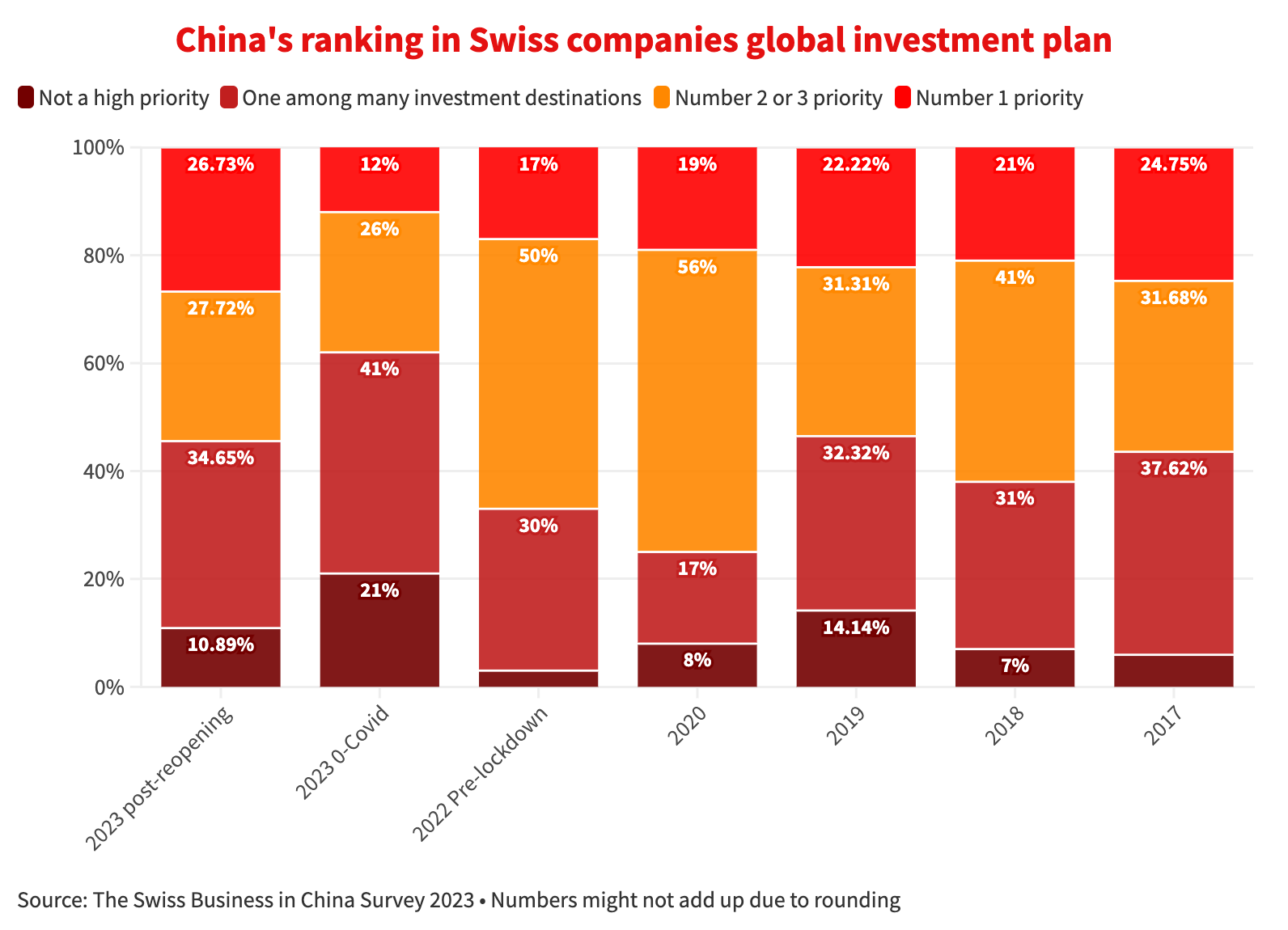

Swiss companies have demonstrated regained confidence in successfully conducting business in China. They now view China as a priority market for investment, similar to the pre-pandemic years. This reflects their resilience and adaptability in navigating the challenges brought about by the pandemic.

However, while confidence has rebounded, Swiss businesses have also tempered their expectations for sales and profit growth compared to previous years. The impact of the pandemic and changing market dynamics have influenced these lowered expectations.

Nonetheless, they still recognize the growth potential that China offers.

Throughout the pandemic period, Swiss companies in China have exhibited resilience. Many have utilized the crisis to enhance their operational efficiency, benefiting from reduced competition and a more favorable human resources situation. This adaptability has helped them weather the challenges. The Survey also reveals a shift in the challenges faced by Swiss firms in China. Previously highlighted issues related to innovation and research and development (R&D) are now seen as less significant. It remains to be seen whether this shift is due to decreased competition or a strategic adjustment in their innovation and R&D activities.

On the other hand, persistent regulatory challenges continue to shape the business environment in China for Swiss companies. Furthermore, considering the cautious investment plans, Swiss companies are approaching their investments in China with care. Indeed, while growth and profit expectations remain positive, the uncertainties and geopolitical landscape have influenced their decision-making process.

Profitability and investment prospects

The timing of the Survey, conducted after the Chinese government’s announcement to end the zero-COVID lockdown restrictions in January, had a significant impact on the expected business performance of Swiss companies for 2023. While prior to the reopening the majority of businesses expected an annual drop in total sales, the percentage decreased from 51 percent to 25 percent after the announcement, indicating renewed confidence from firms and investors.

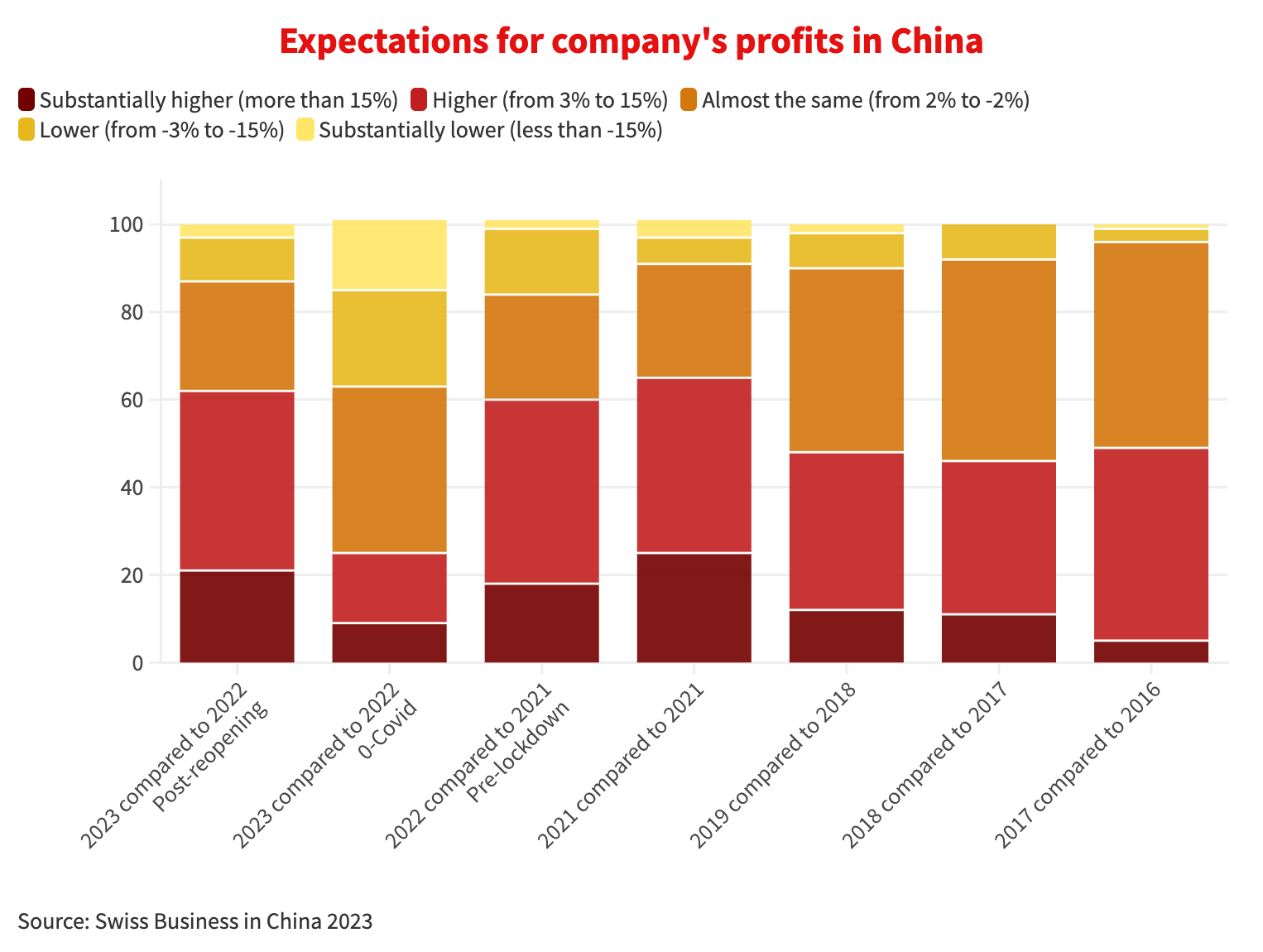

This is also reflected in the overall proportional expectation for higher profits, which explains how Swiss companies have grasped the opportunities created by the pandemic to become more efficient in China. Post-reopening, 21 percent of respondents expect higher profits than the previous year, and definitely more than compared to the zero-COVID period. Indeed, in 2023, the overall proportional expectations compared to sales, suggest that businesses have learned how to work more efficiently amid the pandemic.

As such, 38 percent of the respondents plan to increase investments in China, and they see the market as a top priority – always ranked in first, second, or third place as an investment destination – in numbers that are very close to those of the pre-pandemic years. In addition, the Survey also reveals that Shanghai, Beijing, Suzhou, Shenzhen, and Hangzhou are the top five investment locations for Swiss businesses in China.

Success and competitive advantage in China

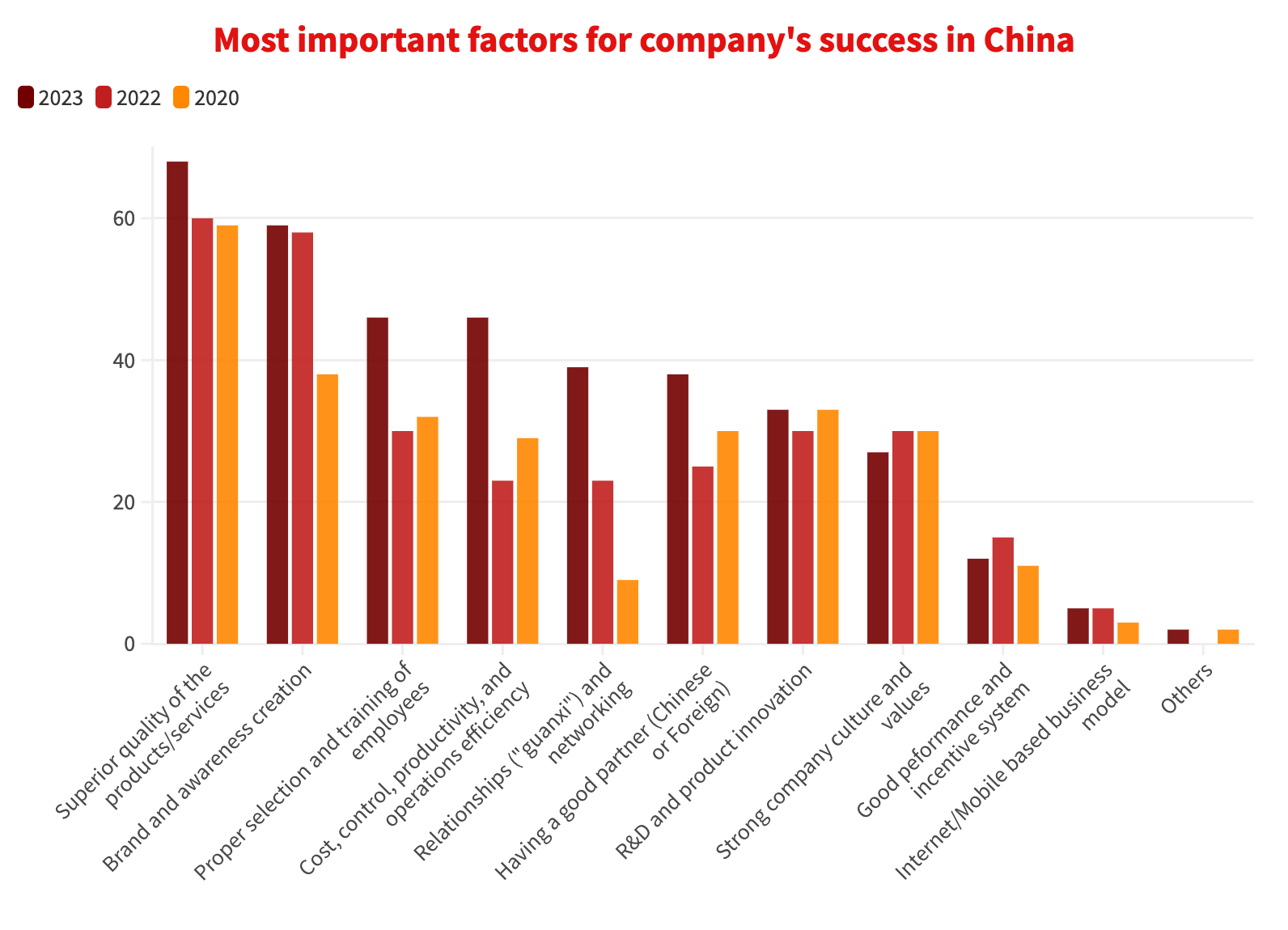

Post-pandemic, Swiss companies have not altered their approach to achieving successful sales and marketing outcomes for their products and services. The fundamental factors of superior quality, branding, and effective human resources still play a crucial role in their success. However, these past three years have introduced a new emphasis on cost control and efficiency.

Despite the challenges faced during the pandemic, Swiss companies recognize the significance of maintaining their commitment to delivering high-quality products and services. They understand that customers continue to value superior quality and are willing to invest in products that meet their expectations.

Moreover, branding remains a vital aspect of Swiss companies’ sales and marketing strategies. Building a strong brand reputation helps in establishing trust and loyalty among customers, distinguishing their offerings from competitors, and attracting a loyal customer base.

While quality and branding remain essential, the pandemic years have emphasized the need for cost control and efficiency. Companies have realized the importance of optimizing their operational processes, supply chains, and resource allocation to enhance efficiency and reduce unnecessary expenses. By streamlining their operations and implementing cost-saving measures, they can maintain competitiveness and improve their bottom line.

Additionally, effective human resources management continues to be a critical success factor for Swiss companies. Having skilled and motivated employees who understand the company’s values and goals is instrumental in delivering exceptional customer experiences and driving sales.

Comparison between Swiss, German, British, and American businesses in China

The Survey also includes a section that offers a comparison between the data collected from Swiss businesses and those derived from similar surveys conducted by the British Chamber of Commerce in China, the German Chamber of Commerce in China, and the American Chamber of Commerce in the People’s Republic of China.

The data show that the business outlook for all countries experienced a constant decline in the challenging economic environment. After the lifting of the zero-COVID policy, however, both Swiss and American companies experienced a significant improvement in their future prospects. Swiss companies saw a 12-percentage point increase in their optimistic outlook, rising from 33 percent to 45 percent. Similarly, American companies witnessed a substantial 26-percentage point rise, going from 33 percent to 59 percent compared to the zero-COVID period. This positive trend in future outlook could potentially serve as an indicator for other countries as well.

Regarding profit expectations, in 2022 when strict COVID-19 preventive measures were still in place, all peer groups had moderately low expectations. German companies experienced a slight decline in the number of businesses expecting increased profits, dropping from 41 percent to 37 percent when comparing the pre-lockdown to the zero-COVID phase. In contrast, Swiss and American businesses were more pessimistic during this time. Swiss companies saw a 29-percentage point decrease, going from 60 percent to 31 percent, while American businesses had a 23-percentage point decrease, declining from 56 percent to 33 percent.

However, the post-reopening period brought a recovery in profit expectations. Currently, 61 percent of Swiss companies and 39 percent of American companies expect higher profits for the current year compared to 2022. This recovery brings profit expectations back to pre-lockdown levels, suggesting a potential trend that German and British peers may likely follow.

Opportunities offered by China’s digital and AI economy

The Survey analysis also dedicates a section to discuss opportunities offered to Swiss and European firms by China’s growing digital sphere. The rapid development of artificial intelligence (AI) in China presents both opportunities and challenges for multinational firms, business leaders, and investors. China has emerged as a global leader in AI, with significant advancements in various sectors, including autonomous driving, smart cities, medical imaging, intelligent voice, and computer vision. This thriving market offers immense potential for value creation, as projected by the global consultancy McKinsey, with estimated business opportunities worth up to US$600 billion by 2030.

At the same time, the country’s regulatory regime on AI has significant implications for multinational businesses. China has established a robust data governance apparatus and is actively shaping international standards on data policy. This regulatory environment allows the imposition of restrictions on data flows, potentially creating digital trade barriers for foreign firms operating in the country.

As such, foreign firms must consider how to address China’s AI development and formulate their entry, expansion, and innovation strategies while remaining competitive. It is crucial for businesses to understand and comply with China’s regulatory landscape, including data governance and privacy laws. As suggested in the Survey, European firms, including Swiss companies, should demonstrate their commitment to data security and trustworthiness. In exchange, by offering guarantees on data security and respecting Chinese regulations, European firms can build trust with customers and partners in China.

An often-mentioned example of this is the healthcare sector, which presents significant opportunities for AI applications in China. The Chinese government has enacted laws promoting the use of big data and AI in improving citizen health. Foreign firms can leverage this initiative by developing AI-based products, services, and business models that align with China’s healthcare goals.

According to the analysis provided in the Survey, striking a balance between complying with home country regulations and adhering to Chinese requirements is critical to the success of future business operations in the country. Swiss firms, in particular, will need to carefully assess the risks and opportunities presented by China’s AI market and develop a decision-making support framework that aligns with their business objectives and global strategy.

Key takeaways

All in all, the Survey offers many insights and some precious takeaways, of great value for foreign businesses and investors, as summarized below:

- Regained confidence: Swiss companies operating in China have regained their confidence and view China as a priority market for investment. The confidence index has reached its highest level since 2014, indicating a renewed positive outlook for Swiss businesses in China.

- Lowered expectations: While confidence has rebounded, Swiss companies have tempered their expectations for sales and profit growth compared to previous years. The impact of the pandemic and changing market dynamics have influenced these lowered expectations.

- Resilience and adaptability: China businesses have exhibited resilience during the pandemic, utilizing the crisis to enhance operational efficiency and benefit from reduced competition and favorable human resources conditions.

- Shift in challenges: The challenges faced by Swiss firms in China have shifted. Issues related to innovation and R&D have become less significant, while regulatory challenges persist as a major factor shaping the business environment.

- Cautious investment plans: Swiss companies approach their investments in China with care due to uncertainties and the geopolitical landscape. Despite this cautious approach, 38 percent of respondents plan to increase investments in China, reflecting the growth potential they recognize.

- Success factors: Superior quality, branding, and effective human resources management continue to be crucial for Swiss companies’ success in the Chinese market. Additionally, cost control and efficiency have gained importance during the pandemic years.

- Opportunities in China’s digital and AI economy: China’s rapid development in AI presents both opportunities and challenges for Swiss and European firms. The growing digital sphere offers significant potential for value creation, but compliance with China’s regulatory landscape, including data governance and privacy laws, is essential.

- Balancing compliance and innovation: Striking a balance between complying with home country regulations and adhering to Chinese requirements is critical for the success of future business operations in China. Swiss firms need to carefully assess risks and opportunities in China’s AI market and align their decision-making with their business objectives and global strategy.

In navigating the evolving business landscape in China, foreign companies can benefit from the expertise and support offered by Dezan Shira & Associates. We provide a comprehensive set of tools and resources to enhance digital sales and marketing strategies, optimize operational processes, and navigate regulatory challenges. By leveraging our expertise, foreign companies can effectively position themselves in the digital and AI economy, ensure compliance with Chinese regulations, and make informed decisions to drive growth and profitability in China.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, Dubai (UAE), and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Understanding China’s Rapidly Growing Healthcare Market

- Next Article Shanghai Looks to Attract Foreign Investors with New Measures